Early

Investors,

Long-term

Partners.

We strive to be the most accessible and supportive early-stage investor. We seek entrepreneurs with product vision, consumer insight, focused execution, resilient attitude and extreme commitment.

We are part of a business family, which has created multiple successful brands which have been in existence over decades. Therefore, we have lived a similar journey and understand what it takes to build a successful business.

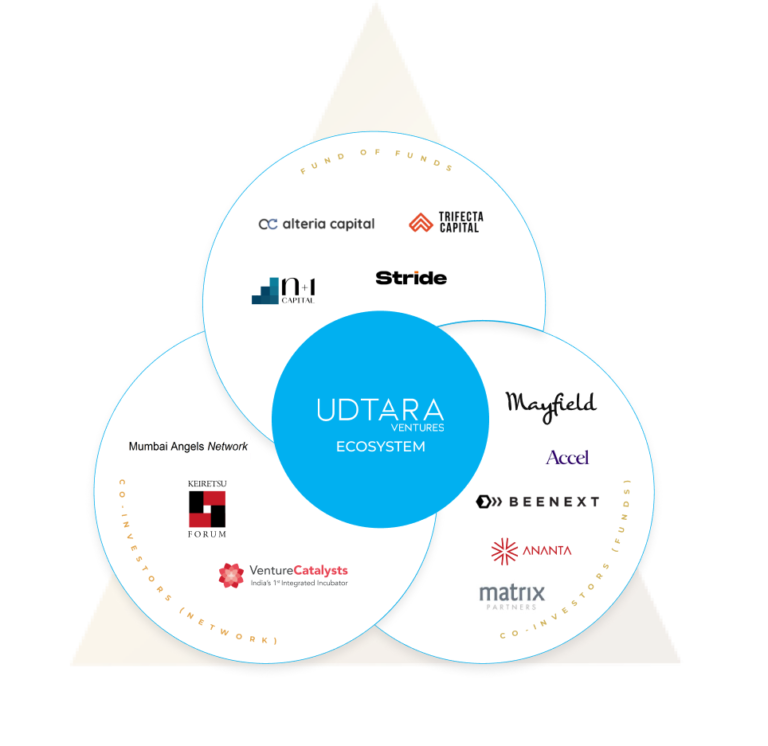

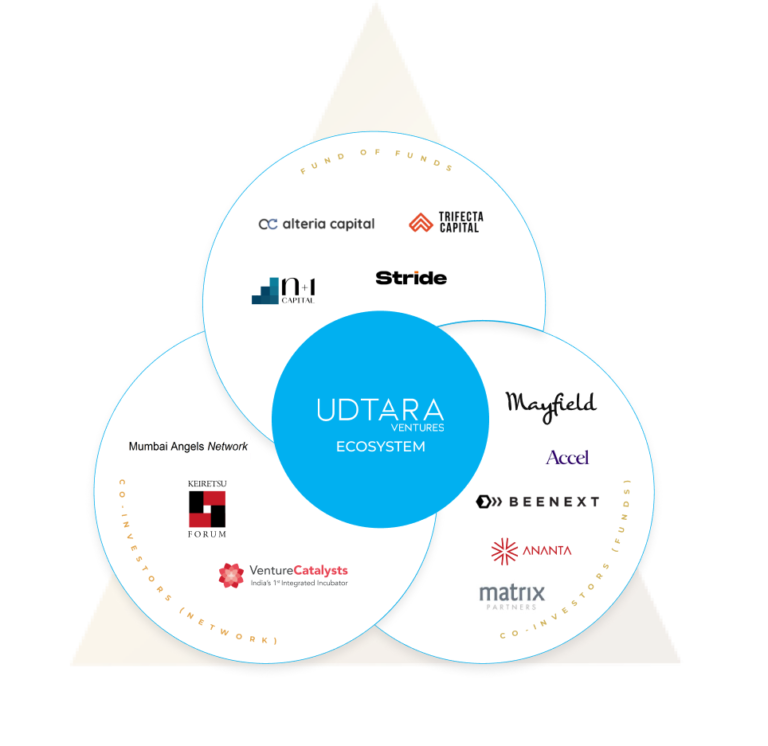

We believe that entrepreneurs are the leaders who bring a progressive change to the world, but such challenges are difficult to overcome without a strong support system. We exist to support founders to turn their vision into reality. We leverage the knowledge, connects and experience available in Udtara ecosystem – a community of founders, fund managers, co-investors, professionals & advisors. We focus on building better ways for everyone in our ecosystem to connect, share and learn from each other.

₹ 1 to ₹ 10 Cr

Ticket Size

₹ 150 Cr

Fund

Seed to Series A

Stage

$20M

Fund

$100K to $1M

Ticket Size

Seed to Series

A

Stage

Early

Investors,

Long-term

Partners.

We strive to be the most accessible and supportive early-stage investor. We seek entrepreneurs with product vision, consumer insight, focused execution, resilient attitude and extreme commitment.

We are part of a business family, which has created multiple successful brands which have been in existence over decades. Therefore, we have lived a similar journey and understand what it takes to build a successful business.

We believe that entrepreneurs are the leaders who bring a progressive change to the world, but such challenges are difficult to overcome without a strong support system. We exist to support founders to turn their vision into reality. We leverage the knowledge, connects and experience available in Udtara ecosystem – a community of founders, fund managers, co-investors, professionals & advisors. We focus on building better ways for everyone in our ecosystem to connect, share and learn from each other.

₹ 1 to ₹ 10 Cr

Ticket Size

₹ 150 Cr

Fund

Seed to Series A

Stage

$20M

Fund

$100K to $1M

Ticket Size

Seed to Series

A

Stage

Our Journey so far

(#)

(USD Mn)

(#)

(USD Mn)

What we Invest in?

Sector Agnostic

Early Stage

Tech Companies

What we Look for?

Founders

Experience

Founders Experience

Product

Market Fit

Product Market Fit

Proprietary

Tech

Proprietary Tech

Founders

Experience

Founders Experience

Product

Market Fit

Product Market Fit

Proprietary

Tech

Proprietary Tech

Compounding

Moats

Compunding Moats

Network

Effect

Network Effect

Compounding

Moats

Compunding Moats

Network

Effect

Network Effect

Why Udtara Ventures?

Network

We enable our founders to engage with domain experts and extend market information for an informed decision making;

Ecosystem

We also invest as LP’s in both VC and Venture Debt funds to deepen our relationship with funds, where our high growth companies can directly pitch to our associated funds to fasten their growth journey;

Patient Capital

Unlike VC or PE funds, our funds are proprietary and hence we are not mandated to generate returns in stipulated timelines, hence we can stay invested for a long term;

Network

We enable our founders to engage with domain experts and extend market information for an informed decision making;

Ecosystem

We also invest as LP’s in both VC and Venture Debt funds to deepen our relationship with funds, where our high growth companies can directly pitch to our associated funds to fasten their growth journey;

Patient Capital

Unlike VC or PE funds, our funds are proprietary and hence we are not mandated to generate returns in stipulated timelines, hence we can stay invested for a long term;

Follow on Rounds

We back limited number of companies and intend to do multiple follow on rounds, so that founders can focus on the execution of their vision.

Founders First

We shield our founders equity by extending debt support either directly or via our venture debt funds to reduce the dilution of founders;

Preemptive Pivot

Building large businesses have taught us the value of pivoting our path, but staying focused on our Goal, we share our knowledge with our companies to remain swift and nimble through their journey.

Follow on Rounds

We back limited number of companies and intend to do multiple follow on rounds, so that founders can focus on the execution of their vision.

Founders First

We shield our founders equity by extending debt support either directly or via our venture debt funds to reduce the dilution of founders;

Preemptive Pivot

Building large businesses have taught us the value of pivoting our path, but staying focused on our Goal, we share our knowledge with our companies to remain swift and nimble through their journey.